Board Linkages: Finding Quality in Board Quantity

Social networks have expanded the reach of our personal and professional relationships, leading us to develop connections and gain access to information that we otherwise may not have access to. We know the undeniable impact of social networks on individuals. But what’s perhaps less obvious is the importance and impact of social networks on corporate success. As with individuals, social networks embedded in the corporate setting, most notably among boards of directors, facilitate the exchange of ideas and increase the flow of information among and between corporate boards. Our research demonstrates that using this nonfinancial data to augment our quality factor can lead to improved returns for asset owners.

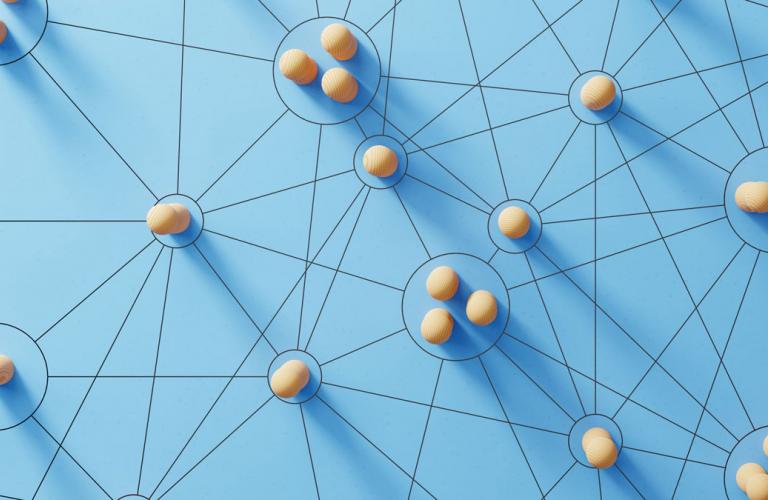

Social network theory studies and explains the relationship between entities or nodes within a network. Companies form an intricate web of connections through various social and professional networks that can include owners, sell-side analyst, customers, and suppliers. In this study, we focus on company networks through their boards of directors. The interconnectedness that facilitates the exchange of ideas and the flow of information between corporate boards, known as interlocked directorate or board linkages, is well documented in academic literature. We leverage this existing social network analysis and incorporate graph theory to analyze the effects of broadening networks among corporate boards.